The start of 2024 has brought good news to the property world with average mortgage rates falling to their lowest level in seven months!

This leaves us wondering… Could there be further decreases ahead of us in 2024?

New year homebuyers have caused a jump in demand in the property market. This has left mortgage lenders competing against each other to attract new clients. Competition between lenders means only one thing… competitive rates.

We are now seeing rates begin to fall below 4%, with major providers such as HSBC, Santander & Halifax starting the year off with significant cuts. Data collated by Rightmove states that the current average five-year fixed mortgage rate has now dropped below 5%, at 4.94%. This is the lowest average rate we have seen since July. For those looking to take out a new mortgage or those coming to the end of their fixed-rate period, this is definitely good news. But is this a start of an ongoing trend?

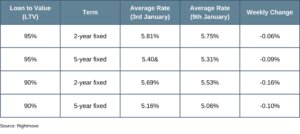

Inflation has a big impact on our economy and therefore mortgage rates. The inflation rate is believed to have peaked, having shown a general downward trend since October. This belief has lead to the Bank of England freezing base rate increases, locking the base rate at 5.25% for three consecutive months. Economists believe the Bank of England will begin to cut interest rates into Spring and Summer. With this belief that base rates are to decrease in the first half of this year, some mortgage lenders have already announced cuts to their rates. However, average mortgage rates still remain higher than previous years. So, what are the current average mortgage rates?

Current Average UK Mortgage Rates:

(As of Tuesday 9th January)

Recently, mortgage rates have slowly decreased marginally week on week. Whether or not these decreases will continue throughout 2024 depends strongly on whether the predicted decrease in base rate comes to fruition. It is difficult to say when we may see more sizeable decreases in mortgage rates, as it is dependent on a few different financial factors.

What does this mean for the property market?

A positive change in mortgage rates means only one thing… more buyers! Affordability improvements will mean an increase in first-time buyers coming to the market, as well as home-buyers looking to upsize, as taking on a mortgage becomes less daunting for many. In recent months, the economy has caused a so-called ‘buyers market’ where there is less competition between buyers, leading to competitive pricing by sellers. As mortgage rates improve, more buyers come to market, causing the pendulum to begin to swing towards a ‘sellers market’ where more competition between buyers puts the ball back in the sellers court.

Want to know more about mortgage rates or the property market? Get in touch with us today for expert advice from your local property experts. Call us on 01323 440678.

Data sources: Rightmove, MoneyWeek, Office for National Statistics.

Up, Out and Down

Up, Out and Down Celebrate Local History Month by Discovering Our Area’s Past

Celebrate Local History Month by Discovering Our Area’s Past First-Time Buyers: Facts and Figures from around the World

First-Time Buyers: Facts and Figures from around the World April 2024 Market Update

April 2024 Market Update Home for Baby

Home for Baby The Three Home Improvements That Impress Buyers the Most

The Three Home Improvements That Impress Buyers the Most Step It Up: Top Tips to Help You Walk More

Step It Up: Top Tips to Help You Walk More Parking Opportunities for Homeowners

Parking Opportunities for Homeowners Property Viewings: Should Sellers Stay In or Go Out?

Property Viewings: Should Sellers Stay In or Go Out? How Hailsham & Eastbourne Can Create a Better Community over a Cuppa

How Hailsham & Eastbourne Can Create a Better Community over a Cuppa